stamp duty exemption malaysia 2017

Original copy of Marriagebirth certificate. There are also special tax incentives for new immigrants to encourage aliyah.

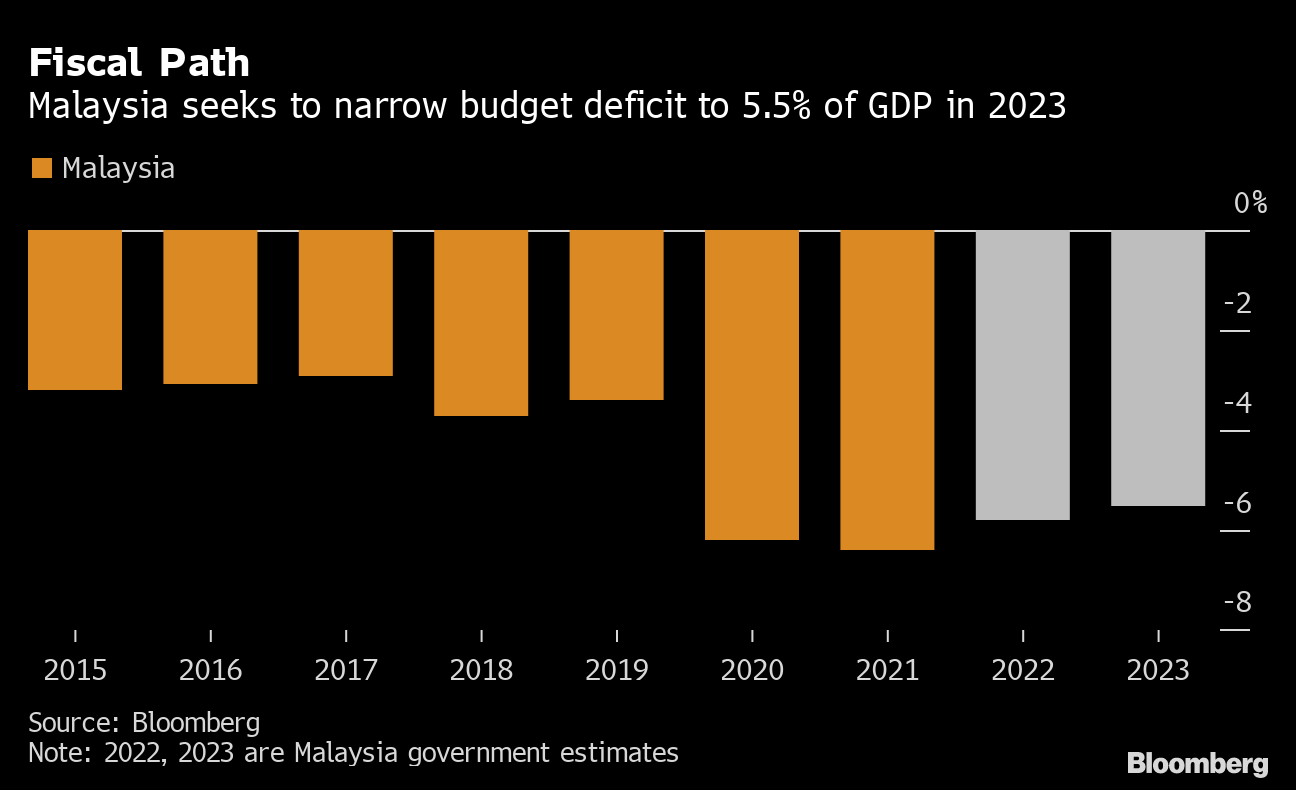

Malaysia S Scaled Back Budget Woos Voters With Tax Cuts Bloomberg

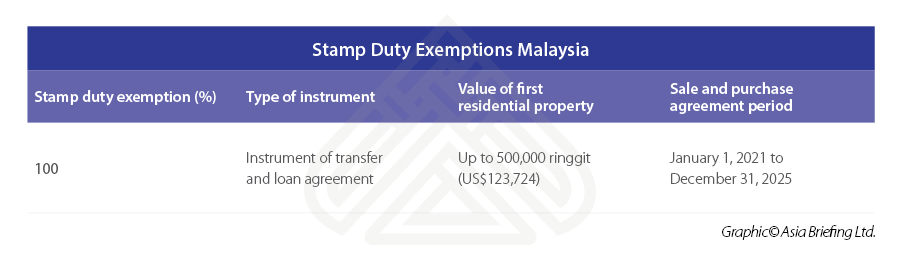

The 100 stamp duty exemption for first-time homeowners remains applicable for properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-Miliki initiative from June 1 2022 to December 2023.

. Pension and Unemployment Insurance. Tax Audit Framework On Finance and Insurance Superceded by the Tax Audit Framework On Finance and Insurance 18112020 - Refer Year 2020. Corporate tax individual income tax and sales tax including VAT and GST and capital gains.

Tax Audit Framework On Withholding Tax available in Malay version only 01082015. The Property Price greater than RM500000. 2 days agoIf youre a first-home buyer you may also be eligible for a stamp duty concession or even an exemption from paying it altogether.

2 days agoA visa from the Latin charta visa meaning paper that has been seen is a conditional authorization granted by a polity to a foreigner that allows them to enter remain within or leave its territory. And this is followed by VAT exemption for such small-scale VAT payers from 1 April to 31 December 2022. 2 days agoSingapore-headquartered multinational enterprises MNEs meeting certain conditions are required to prepare and file CbC Reports to IRAS for financial years FYs beginning on or after 1 Jan 2017.

Relation between the tax revenue to GDP ratio and the real. For example in some jurisdictions you can obtain an exemption when you transfer an asset between entities within a corporate group as defined in the legislation. 2022-6-22In a land and building transfer the acquirer is liable for duty on the acquisition of land and building rights Bea Pengalihan Hak atas Tanah dan Bangunan or BPHTB at a maximum of 5 of the greater of the transaction value or the government-determined value.

I exemption of excise duty to purchase a new locally assembled vehicle completely knocked-down -ckd. Similar to PBB BPHTB has been made a part of regional taxes. 2022-6-30If no exemption is applied the property tax paid can be used to offset against the profits tax payable by the corporation.

2022-10-7KUALA LUMPUR Oct 7. The actual stamp duty will be rounded up according to the Stamp Act. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

Please note that the above formula merely provides estimated stamp duty. For First RM100000 RM1000 Stamp duty Fee 2. 2022-9-23Its minister Datuk Seri Reezal Merican Naina Merican pictured said that for now full stamp duty exemption was only for first-time homeowners of properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-MILIKI while houses priced above RM500000 to RM1 million were given a 50 stamp duty exemption.

RM9000-RM9000 RM000 Stamp Duty to pay Saving Amount. Loan Sum x 05 Note. 2022-6-13Malaysia has a wide variety of incentives covering the major industry sectors.

Tax Audit Framework Superceded by the Tax Audit Framework 01052017. 2022-10-18This article lists countries alphabetically with total tax revenue as a percentage of gross domestic product GDP for the listed countries. ASCII characters only characters found on a standard US keyboard.

2 days agoA comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. Loan Sum 300000 X 05. First-Home Buyer Assistance Program FHBAS As part of the NSW governments policy to help new homeowners onto the property ladder from 1 July 2017 the NSW government abolished stamp duty for first-home buyers.

This page is currently under maintenance. There are virtually millions. Stamp duty exemption on instruments of transfer of real property or lease of land or building used for the purpose of carrying on a qualifying activity executed on or after 13 June.

RM100001 To RM500000 RM8000 Total stamp duty must pay is RM900000 After first-time house buyer stamp duty exemption. Following Israels social justice protests in July 2011 Prime Minister Benjamin Netanyahu. 2021-10-8An approved participant under the mm2h programme with mm2h visa approved from 1 january 2017 is eligible for.

The Real Estate and Housing Developers Association of Malaysia Rehda has appealed to the government to consider extending the 75 stamp duty exemption to all buyers and not just first-time house buyers. Each jurisdiction all of which have very specific requirements. 2022-10-74250 housing units worth RM358mil will be built under the Rumah Mesra Rakyat program.

Original. 2022-10-18Employments contract stamped RM1000 at duty stamp officeEmployment Contractpdf available at website JIM-2 original copies. Purchase of basic supporting equipment for disabled self spouse child or parent.

Or Income Tax Act 1967. Tax incentives can be granted through income exemption or by way of allowances. 2022-10-18Taxation in Israel include income tax capital gains tax value-added tax and land appreciation taxThe primary law on income taxes in Israel is codified in the Income Tax Ordinance.

2021-7-15The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption-Stamp duty Fee 1. The tax percentage for each country listed in the source has been added to the chart. The list focuses on the main types of taxes.

Federal Legislation Portal Malaysia. An estimated 50 of Irans GDP was exempt from taxes in FY 2004. VAT land appreciation tax and stamp duty plus some minor local taxes upon the disposal of real property in China.

Original. Stamp duty is charged on transfer of Hong Kong stock by way of sale and purchase at 026 of the consideration or the market value if it is higher per transaction. 1 day agoPwC can assist you with Stamp Duty issues on any type of transaction within any State or Territory of Australia.

Must contain at least 4 different symbols. Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. Or ii exemption of import duty and excise duty to import a pre-owned private vehicle completely built-up - cbu into malaysia.

Stamp duty exemption is capped at RM300000 on the property market value and loan amount. 2022-10-9Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. Visas typically include limits on the duration of the foreigners stay areas within the country they may enter the dates they may enter the number of permitted.

Tax revenue as percentage of GDP in the European Union. 2022-10-17A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right. Such a move will benefit a wider pool of buyers especially the upgraders said Rehda president Datuk NK Tong.

2022-10-18Get the latest international news and world events from Asia Europe the Middle East and more. 6 to 30 characters long.

M Sians Views On I Miliki Stamp Duty Exemption For First Time Homebuyers

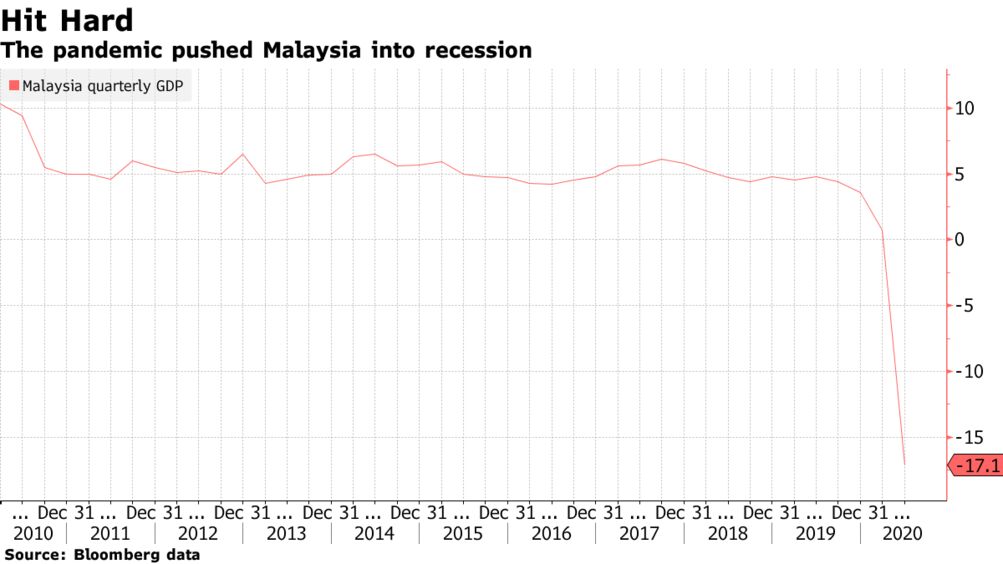

Malaysia Budget Boosts Development Spending To Buffer Virus Hit Bloomberg

Urban 360 By F3 Capital Group Home Facebook

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia Edgeprop My

Uncategorized Your Real Estate Partner

The 2019 Stamp Duty 大马房地产爆料站property Insight Malaysia Facebook

Stamp Duty Exemption For House Buyers Infographics Propertyguru Com My

Kw Malaysia Positive About Stamp Duty Exemption Expected More Measures To Boost Property Market Edgeprop My

Changes Proposed To Stamp Act In Malaysia Conventus Law

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Corporate Tax Guide Hong Kong Special Administrative Region Htj Tax

Budget 2017 What It Means For Malaysian Property Buyers Owners And Investors Propsocial

Airasia Moving To Main Terminal In Kuala Lumpur By January 1 2017 Loyaltylobby

Stamp Duty Exemption For The Year 2022 Malaysia Housing Loan

Budget 2017 Budget 2017 A Let Down For Property Players The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

Indirect Tax And Stamp Duty Measures In Malaysia For 2021

0 Response to "stamp duty exemption malaysia 2017"

Post a Comment